Market Snapshot: Three Pipeline Systems Transport Growing Natural Gas from Northeast BC to Markets

Connect/Contact Us

Please send comments, questions, or suggestions for Market Snapshot topics to snapshots@cer-rec.gc.ca

Release date: 2024-01-24

Northeast British Columbia (BC) is an area of growing natural gas production in Canada. Development of tight gasDefinition* in the Montney Formation is the main reason why BC’s natural gas production more than doubled between 2010 and 2022. In 2010, BC’s natural gas production averaged only 2.88 billion cubic feet per day (Bcf/d), and in 2022 it grew to 6.14 Bcf/d. In comparison, Western Canadian natural gas production in 2022 was 17.3 Bcf/d, averaging as high as 17.9 Bcf/d in November.

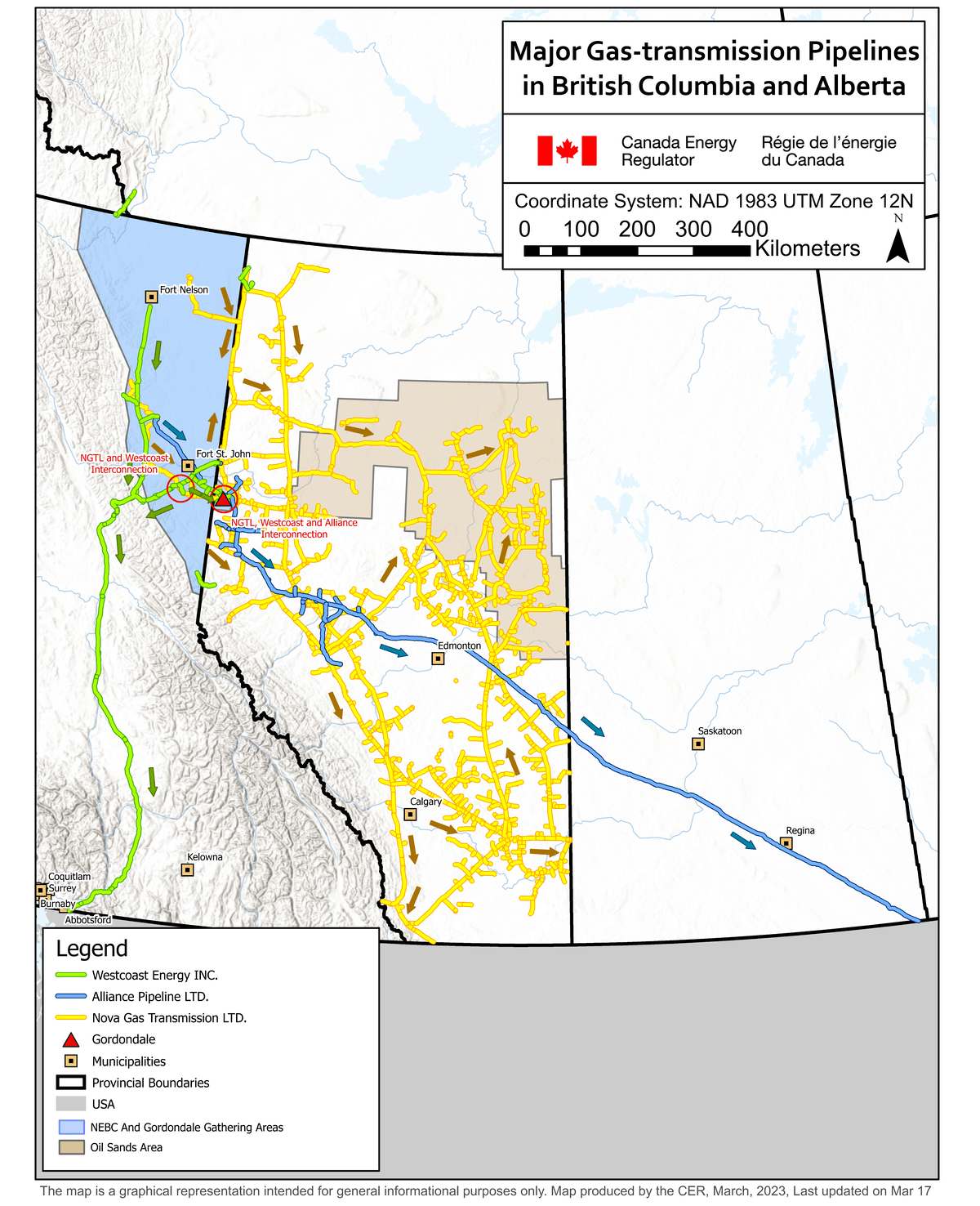

Three major pipeline systems in northeast BC transport the growing volumes of natural gas produced in the region to markets:

- NOVA Gas Transmission (NGTL)

- Westcoast Transmission System (also known as Enbridge BC Pipeline)

- Alliance Pipeline

These pipelines also transport gas from around Gordondale, Alberta, just on the other side of the BC-Alberta border, and have major delivery connections both for Canadian and the United States (U.S.) export markets. Westcoast ships gas south to southern BC and exports gas to markets in the U.S. Pacific Northwest, while Alliance ships gas through the Chicago market hub to the U.S. Midwest. NGTL ships gas to the Alberta market, which is connected to the U.S. Pacific Northwest, U.S. Midwest, Eastern Canada, and the U.S. Northeast markets through other pipelines.

Figure 1: Major Transmission Pipelines in British Columbia and Alberta

Source and Description

Source: CER

Description: This map shows three natural gas pipelines: NGTL, Alliance, and Westcoast. It also shows Gordondale, Northeast BC and Gordondale gathering areas, and an oil sands area.

Alliance Pipeline has been serving northeast BC, as well as other areas in Alberta, since 2000. While NGTL has served Alberta since 1957, it first extended its system into BC in 2010 with the Groundbirch Pipeline, and has added other lines in BC since then (like Horn River Mainline in 2012, the Towerbirch Pipeline in 2017, and North Montney Mainline in 2020). Westcoast has been serving northeast BC since 1957.

Factors affecting pipeline flows in major Northeast BC’s natural gas pipeline systems

Growing low-cost gas supply in the past 15 years in North America has significantly changed natural gas markets, particularly in upstream areas where additional pipeline capacity has been brought online to accommodate new gas production. NGTL’s expansions in northeast BC and around Gordondale, Alberta, have increased gas flows onto the system from there, as shown in Figure 2.

Other NGTL projects added more capacity in downstream areas, so NGTL can deliver growing gas supply to consumers, especially in Alberta’s oil sands, where gas demand has been growing. Westcoast, being the main transmission pipeline in BC, also expanded in upstream and downstream areas, due to increasing northeast BC production. This allowed Westcoast to ship more gas to consumers. As a result, flows onto Westcoast increased from 2010 to 2018 as shown in Figure 2, but have declined since. Flows onto the Alliance Pipeline have remained relatively steady, though Alliance has not expanded its capacity in northeast BC since 2008Footnote 1.

Figure 2: Northeast BC & Gordondale (Alberta) gas pipeline flows

Source and Description

Source: CER data, as determined from Alliance Pipeline flows from zone 2, Pipeline Profiles – Alliance, Ft. St. John area and Ft. Nelson Mainline – Westcoast Operational Bulletin, and NGTL flows (contracted receipts on relevant BC and NW Alberta stations).

Description: This stacked area chart shows average monthly gas pipelines flows for NGTL, Alliance, and BC Pipeline from 2010 to 2023.

Reasons for picking different pipeline systems

Shippers on western Canadian gas pipelines are mainly producers, marketers, and large consumers, including large industries and local distribution companies (LDCs). Producers ship gas to buyers or to gas-consuming projects that producers may own, like oil sands projects. Marketers generally purchase gas supplies from producers or other marketers and then resell to larger customers, like industry, power plants, or LDCs. LDCs then resell this gas to residential, commercial, and other customers connected to their gas distribution systems.

Pipeline shippers choose a pipeline for transporting their gas supply to earn the highest possible “netback.” A netback refers to the price at which a commodity producer, such as oil or natural gas, can sell its product after deducting the costs of transportation and other expenses.Footnote 2 Importantly, different pipelines often ship gas to different markets with different prices, meaning netbacks can change depending on the end destination.

To a large extent, gas pipelines in western Canada are contracted long-term, which guarantees pipeline capacity for shippers. It allows the shippers to ship their gas to whatever market they need primarily, especially to export markets where gas prices are periodically higher than western Canadian gas prices. For comparison, 15 years ago, a much larger share of pipeline capacity was uncontracted and booked by shippers on a day-to-day basis.

- Date modified: